Good morning and welcome back to 60 Days.

Today is February 27th, 2023 — the 48th day of the West Virginia Legislature’s regular session.

Today’s briefing is coming to you from your legislative listening post in historic Martinsburg — in the heart of Apple Country where spring appears to have arrived a little early.

The neighborhood daffodils are starting to bloom and the Bradford Pear tree that stands watch outside my front door is beginning to bud and will soon be in full flower.

I admit though, that I’m still bitter about being forced to take time away from celebrating my wife’s birthday because West Virginia lawmakers decided to work over the weekend.

Such is the life of a journalist and those married to one.

Maybe some coffee will improve my mood on this Monday morning.

In case you missed it or perhaps only have a vague idea of what happened at the state Capitol over the weekend, let’s do a quick recap.

Senate leaders ruined by wife’s birthday when they rammed the long-awaited bill to cut taxes through the process on Saturday.

During a meeting of the Senate Finance Committee, lawmakers struck Gov. Jim Justice’s initial plan from the bill passed by the House near the beginning of the session and inserted the compromise plan in its place.

The Finance Committee meeting was brief. The panel advanced the bill to the floor with little to no debate.

And finally, constitutional rules that require bills be read on three consecutive days were suspended on the floor, where the compromise overwhelmingly passed the full state Senate on Saturday on a 33-to-zip vote. Again, with virtually no debate and on a weekend to boot.

The Charleston Gazette-Mail has more on the plan. You can follow this link, but here are the highlights:

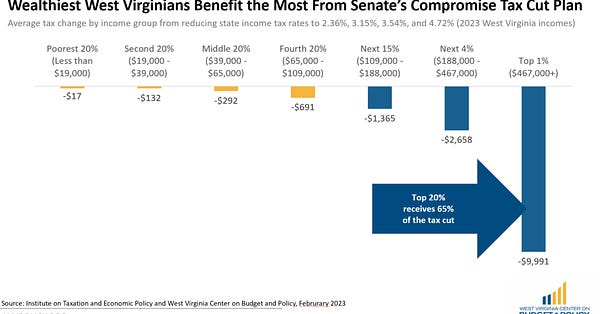

The plan calls for a roughly 21% percent reduction in the personal income tax (PIT for short) across all brackets.

Gov. Justice hailed the bill in a series of tweets saying the PIT reduction mixed with a rebate of the automobile tax, a 50% rebate of the property tax on machinery and inventory to small businesses, and tax credits to West Virginia Veterans would return $750 million to West Virginians and puts the state on a path toward the elimination of personal income taxes.

The bill also contains a trigger provision for future tax reductions.

We wrote yesterday that there is plenty of time to weigh the pros and cons of the tax bill. Lawmakers in the House still have to concur with the changes made in the Senate before it would be sent to the governor’s desk.

You can definitely put Gov. Justice on the “pro” side.

But the left-leaning West Virginia Center on Budget and Policy is throwing cold water on the deal. Click on the tweet to read the Center’s analysis.

If you don’t have time for that, the main points the WVCBP makes are largely in the opening paragraph:

“The legislation, HB 2526, looks very much like the plan they (Senate lawmakers) passed earlier this session (SB 424). Both versions overwhelmingly benefit the wealthy, contain a workaround for the tax cuts rejected by voters via Amendment 2, and contain automatic triggering mechanisms that would ultimately eliminate the state’s personal income tax at the cost of needed budget investments.”

Now that you’re caught up on the battle lines shaping up over the tax plan that’s finally moving through the Legislature, let’s take a look at what’s coming up today.

There’s another public hearing on the schedule. This one hosted by the House Committee on Energy and Manufacturing. The panel is taking public comment on HB 3446. As the Charleston Gazette-Mail reports, the bill would allow the PSC to override local authority for proposed wholesale electric projects.

Following the public hearing in the House Chamber, the floor session will begin at 11 a.m. You can find the complete agenda here.

I usually like to list all of the bills on third reading, but there are so many at the passage stage ahead of “Crossover Day” on Wednesday that it seems futile and just makes the newsletter unnecessarily lengthy.

Let me know if you would prefer I revert back to listing each individual bill.

Today, however, I would simply call your attention to the committee substitute for H. B. 3042, the latest version of the Religious Freedom Restoration Act. It’s on third reading, the passage stage.

Supporters say the bill would ensure religious protection from interference from state or local governments. At least 20 states have a RFRA bill on the books.

Passage would be a win for social conservatives.

Opponents worry it will be used to discriminate, especially against those from the LGBTQ community.

Here’s the House Committee schedule for today:

The Committee on Rules will meet at 10:45 a.m. behind the House chamber.

The Committee on Government Organization will meet at 1:00 p.m. in Room 215-E

The Committee on Education will meet at 2:00 p.m. in Room 432-M.

The Committee on the Judiciary will meet at 3:00 p.m. in Room 460-M

The Senate also gavels in at 11 a.m. The complete floor agenda can be found here.

Nothing really jumps out at me at the passage stage, but if there’s something I missed or if there is a bill that you want us to keep an eye on, please do hit the comment button and reach out. That goes for the House, too.

I would, however, direct your attention to the House-passed bills that Senators are expected to vote on today. If passed, they will go to Gov. Justice for his signature (That is, if the bills haven’t been amended by the Senate. In those cases, the House would have to concur with those changes).

Eng. Com. Sub. for H. B. 2062 - Establish rules and regulations for e-bikes in West Virginia that more closely comport to federal law

Eng. H. B. 3307 - Establishing the West Virginia-Ireland Trade Commission - (Com. amend. and title amend. pending) - (With right to amend)

Eng. H. B. 3340 - To revise the West Virginia Tax Increment Financing Act - (With right to amend)

Eng. H. B. 3428 - Relating to the West Virginia Business Ready Sites Program - (Com. amend. and title amend. pending) - (With right to amend)

Here’s the Senate committee schedule:

9 a.m. — Outdoor Recreation (Room 208W)

10 a.m. — Health & Human Resources (Room 451M)

10:50 a.m. — Rules (Room 219M)

1 p.m.: — Transportation and Infrastructure (Room 451M)

2 p.m. — Banking and Insurance (Room 451M)

3 p.m. — Judiciary (Room 208W)

3 p.m. — Finance (Room 451M)

This committee’s agenda includes SB 593 - Mandating a cost of living salary adjustment policy for state employees

Since Dave and I had a busy weekend, I’m going to leave things here.

Thanks for reading 60 Days.

Questions? Concerns?

Simply reply to this email or better yet, hit the button and leave a comment. Compliments are encouraged, but if you want to complain, we’re here for that, too.

My friend alerted me about SB561 which involves WVDWTRF (drinking water) trying to move that program from Public Health to D Environmental Protection, which seems like a bad idea because DEP has a history of just FINING companies who pollute, rather than making sure the water gets cleaned up--especially given the recent spills into rivers in WV, including the East Palestine, OH train derailment that could leak into the Ohio River.

It was "laid over" in the Senate.

I would like it to STAY that way instead of having the third reading/vote.

There are so many awful bills and not enough time to read them all, let alone address them all.

Thanks for what you guys do!

What makes WVCBP "left-leaning"?